Page 18 - Aramsco About Us 2024 for Flipbook

P. 18

What To Know | About Aramsco

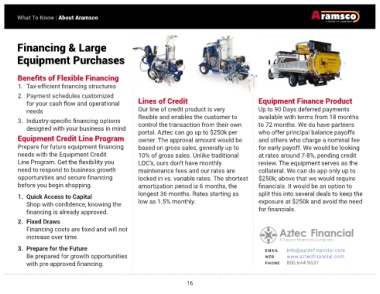

Financing & Large

Equipment Purchases

Benefits of Flexible Financing

1. Tax-efficient financing structures

2. Payment schedules customized

for your cash flow and operational Lines of Credit Equipment Finance Product

needs Our line of credit product is very Up to 90 Days deferred payments

3. Industry-specific financing options flexible and enables the customer to available with terms from 18 months

control the transaction from their own

to 72 months. We do have partners

designed with your business in mind portal. Aztec can go up to $250k per who offer principal balance payoffs

Equipment Credit Line Program owner. The approval amount would be and others who charge a nominal fee

Prepare for future equipment financing based on gross sales, generally up to for early payoff. We would be looking

needs with the Equipment Credit 10% of gross sales. Unlike traditional at rates around 7-8%, pending credit

Line Program. Get the flexibility you LOC’s, ours don’t have monthly review. The equipment serves as the

need to respond to business growth maintenance fees and our rates are collateral. We can do app only up to

opportunities and secure financing locked in vs. variable rates. The shortest $250k; above that we would require

before you begin shopping. amortization period is 6 months, the financials. It would be an option to

1. Quick Access to Capital longest 36 months. Rates starting as split this into several deals to keep the

Shop with confidence, knowing the low as 1.5% monthly. exposure at $250k and avoid the need

financing is already approved. for financials.

2. Fixed Draws

Financing costs are fixed and will not Aztec Financial

increase over time. A Taycor Financial Company

3. Prepare for the Future email info@aztecfinancial.com

Be prepared for growth opportunities web www.aztecfinancial.com

with pre-approved financing. phone 800.644.9537

16